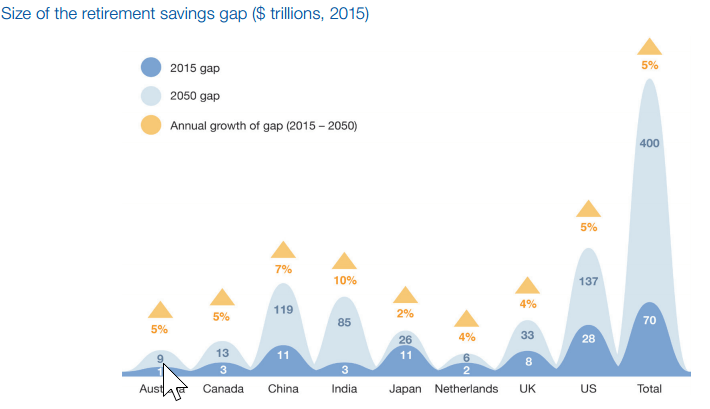

The challenges we face to provide our ageing societies with a financially secure retirement are well-known. In most countries around the world, standards of living and healthcare advancements are allowing people to live longer. This should be celebrated, but we should also consider the implications for the financial systems that have been designed to meet our retirement needs, which in many countries are already under severe strain.

The new World Economic Forum (WEF) a report has been produced as part of the Forum’s Retirement Investment Systems Reform project that has brought together pension experts to assess opportunities for reforms that can be adopted to improve the likelihood of our retirement systems adequately and sustainably supporting future generations.

The key driver of the challenges facing retirement systems is increasing life expectancy and a falling birth rate. This leads to a smaller workforce supporting an ever growing population of retirees.

If increases in life expectancy were matched by corresponding increases in the the retirement age, the challenge would be less acute, but so far we have seen only gradual steps to increase retirement age. In some countries, the retirement age is falling. In Poland, legislation was recently introduced to drop the public retirement age to 65 for men and 60 for women4 . Based on demographic changes alone, workers entering the workforce today should accept and plan for a longer working career; Poland’s approach is only exacerbating the challenge.

The report has identified five additional factors that are putting increasing strain on global retirement systems.

Lack of easy access to pensions

Many workers in developed and developing markets still lack easy access to pension plans and saving products. In many cases there are options available, but take-up is low. The lack of opportunity to begin saving, and encouragement to make putting money aside a habit, is severely limiting many people’s ability to accumulate savings.

The self employed, and informal sector workers are least likely to have access to a workplace savings plan. Those working at smaller companies, where regulation may make providing a plan overly burdensome for employers, are also at a disadvantage.

Long-term, low-growth environment

Over the past 10 years, long-term investment returns have been significantly lower than historic averages. Equities have performed 3%-5% below historic averages and bond returns have typically been 1%-3% lower. Low rates have grown future liabilities, and at the same time investment returns have been lower than expected and unable to make up the growing pension shortfall.

Taken together, these factors have put increased strain on pension funds as well as on long-term investors that have commitments to fund and meet the benefits promised to current and future retirees. Individuals have also been impacted and have seen smaller growth in their retirement balances than in the past.

Low levels of financial literacy

Levels of financial literacy are very low worldwide. This represents a threat to pension systems which are more selfdirected and which rely more on private savings in addition to employer- or government-provided savings.

Research indicates that most people are not able to answer questions on basic financial concepts. This is increasingly important in pension systems that require individuals to make key decisions. The lack of awareness of the basics on how interest and returns will compound over time, how inflation will impact savings, and the benefits of holding a broad selection of assets to diversify risks means that many individuals are ill-equipped to manage their own pension savings. Some groups are particularly vulnerable, including women, the young and those who cannot afford, or choose not to seek, financial advice.

Inadequate savings rates

To support a reasonable level of income in retirement, 10%- 15% of an average annual salary needs to be saved. Today, individual savings rates in most countries are far lower. This is already presenting challenges where traditionally defined benefit structures would have provided a guaranteed pension benefit. Now, as workers look at their defined contribution retirement balances, with no guaranteed benefits, they are realizing that the retirement income their savings will provide will be much lower than expected.

This will continue to be a challenge unless the importance of higher savings rates is better understood and communicated. Given the current long-term, low-growth environment, it is unrealistic to expect that saving ~5% of a paycheck each year of your working life will provide a comparable income in retirement.

High degree of individual responsibility to manage pension

The popularity of defined contribution systems has been growing steadily over the past few decades and they now account for over 50% of global retirement assets. The way that these plans are designed puts a high level of responsibility on individuals to manage their retirement savings. This includes deciding how much to save each year, which investments to choose, how long they are likely to live, when they should retire, and how to withdraw their savings when they do decide to retire full-time.

The information reported to individuals often does not make it easy to make informed decisions to try to meet a target level of retirement income. For example, the account balance does not help individuals understand what they would likely receive as a monthly income and the investment return achieved does not help determine whether to increase savings rates, stay employed longer and delay retirement or take more investment risk.